38+ mortgages for self employed borrowers

Ad Connsolidate 15K Debt With One Easy Payment. Ad Calculate Your Payment with 0 Down.

Self Employed Borrowers Now Face More Mortgage Scrutiny

Apply And See Todays Great Rates From These Online Lenders.

. Either business owners andor 1099 wage earners. Which are geared toward self-employed borrowers and DSCR mortgages. Web 12 24 months of bank statements showing deposits and withdrawals for cash flow evidence You can get online statement copies from your online banking account.

A FICO score of at least 580. 75000 Average yearly income. Web 1 day ago438 out of 5 Stars.

The following are the general non-traditional self-employed mortgage guidelines and requirements. Loan amounts up to 2000000 even higher on a case by case basis Debt to Income up to. A 35 down payment.

Get 0 Down No PMI and More. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web cash Make sure to set aside a 5-10 down payment for your self-employed mortgage.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web According to Freddie Mac sellers might be able to justify providing mortgages to borrowers with at least 12-month self-employment work histories. 70000 65K 75K 2 Monthly income.

Thats true sort of. This amount is typically required by lenders and will vary. Web With the pandemic putting so much of their lives and livelihoods in flux the Federal Housing Finance Agency FHFA established guidance to use extra scrutiny with these self-employed home buyers.

Save Real Money Today. Ad Best Mortgage Loans Compared Reviewed. These mortgages typically require a credit score in the low.

The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the. Ad Only Takes Minutes to Check 0 Down No PMI and Interest Rates with a Loan Specialist. Credit scores down to 500 FICO.

Web 600 659 20 down payment. Down payment requirements depends on borrowers credit scores. We have home loans tailored for self-employed contractors and 1099 workers.

Ad Quontics mortgages are a great option for borrowers with alternative income documentation. Web Heres a brief look at the four loan options you might use as a self-employed borrower. Web Many mortgage writers and lenders say self-employed applicants are not held to a higher standard than W-2 employees.

Youre more likely to get approved and have favorable loan. It Only Takes Minutes to See What You Qualify For. EDT 7 Min Read As lenders seek new clients many are now looking for opportunities among self-employed and small-business.

We have home loans tailored for self-employed contractors and 1099 workers. A debt-to-income ratio below 50 percent. Use Our Comparison Site Find Out Which Lender Suites You The Best.

660 and higher 10 down payment. Its possible to find an FHA lender willing to approve a. Web Borrowers need to be self-employed.

Self-employed borrowers have to hit the same credit income and asset marks that wage earners do although proving their income can be a bit more challenging. Minimum Credit Score 620. 10 to 20 down payment.

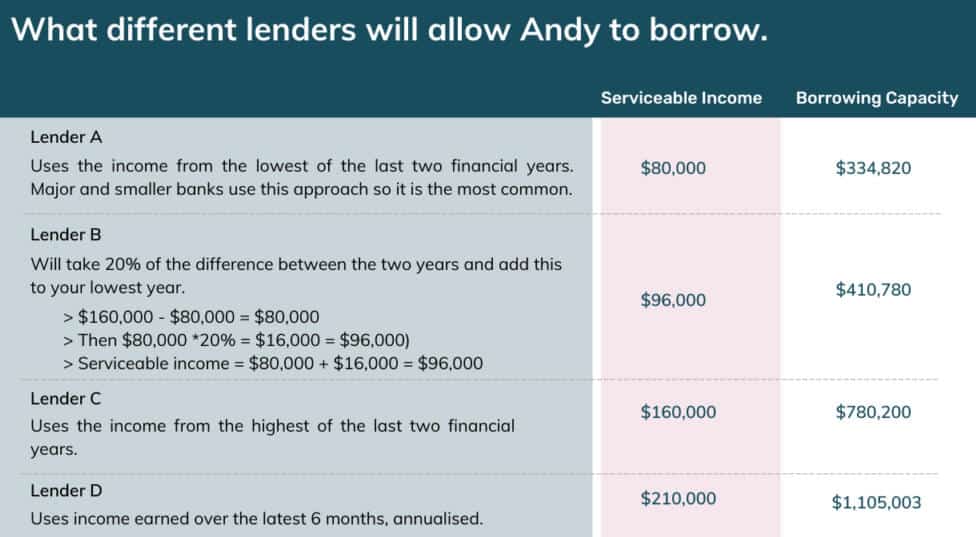

Skip The Bank Save. Find A Lender That Offers Great Service. Web Heres how a lender would calculate your monthly income for qualifying purposes.

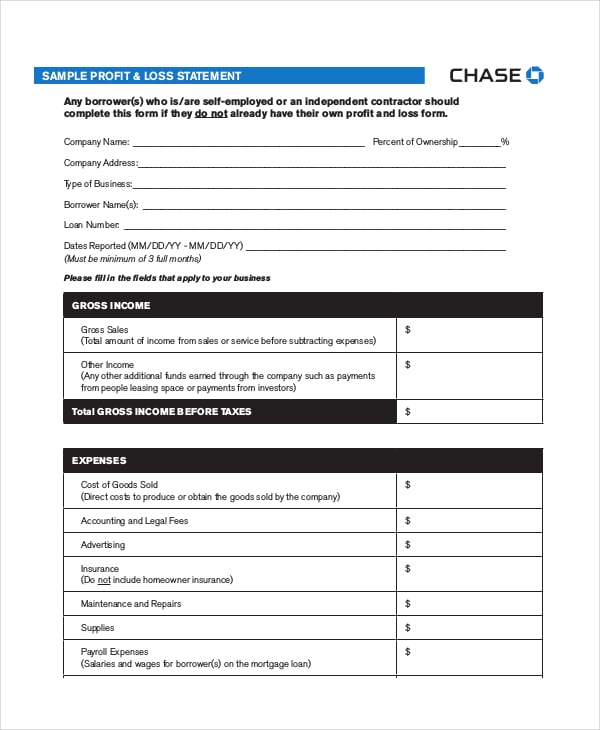

Either an audited PL statement or an. Ad Compare More Than Just Rates. Web To get approved youll need.

Web The new rules require self-employed borrowers to provide one or two new documents when applying for a mortgage. Take Advantage of Your Hard-Earned VA Mortgage Benefits. Ad Quontics mortgages are a great option for borrowers with alternative income documentation.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web The lender must prepare a written evaluation of its analysis of a self-employed borrowers personal income including the business income or loss reported on the borrowers individual income tax returns. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Web May 11 2022 1022 am. Web Self-employed mortgage borrowers can qualify for conventional and government-backed loans. Find The Best Plan For You Now.

Apply Easily Get Pre Approved In Minutes. Web One problem that self-employed individuals run into is that they use business expenses to reduce taxable income which means less qualifying income for a.

Self Employed Mortgages For 2023 Best Self Employed Lenders

Home Loans For Self Employed Borrowers 5 Quick Tips

Self Employed Home Loans 2021 How To Get Prepared How To Get A Home Loan

Getting A Mortgage As A Self Employed Borrower Realty 101 Blog

New Self Employed Mortgage Guidelines Mortgages For Self Employed Borrowers Youtube

Self Employed Mortgages Guide Moneysupermarket

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Profit Loss Statement Template 13 Free Pdf Excel Documents Download

Top 4 Home Loans For Self Employed Borrowers How To Get Approved

Fannie Mae Issues Lender Letter On Self Employment Income Housingwire

Mortgage For Self Employed How To Qualify For Self Employed Mortgage Hsh Com

Self Employed Mortgages For 2023 Best Self Employed Lenders

2023 Mortgage Guide For Self Employed Borrowers

Self Employed Mortgage Loans With No Income Documentation

Self Employed Mortgage Loan Requirements In 2023

Central Coast Mortgage Broker Better Loan Rates Mortgage Choice

How Do I Apply For A Mortgage When I M Self Employed The Accountancy Partnership