Ppp 941 calculator

Ensure you are correctly calculating monthly payroll. 2021-33 provides a safe harbor on figuring gross receipts solely for determining eligibility for the.

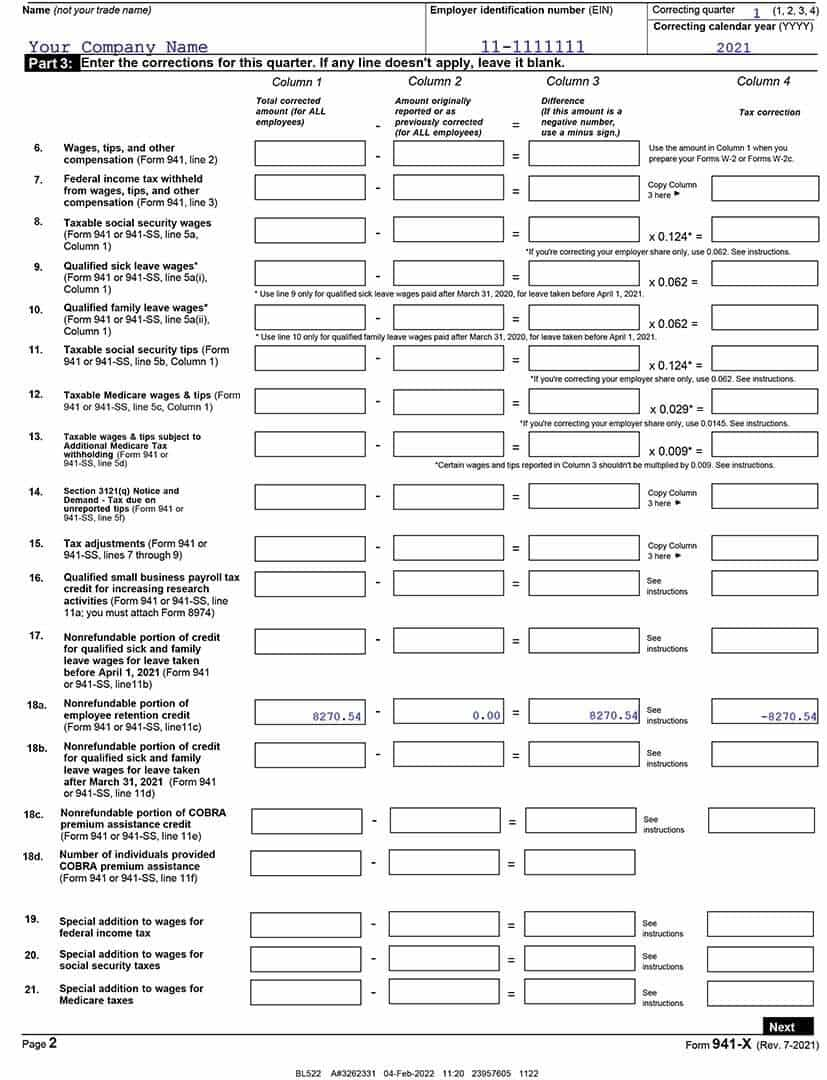

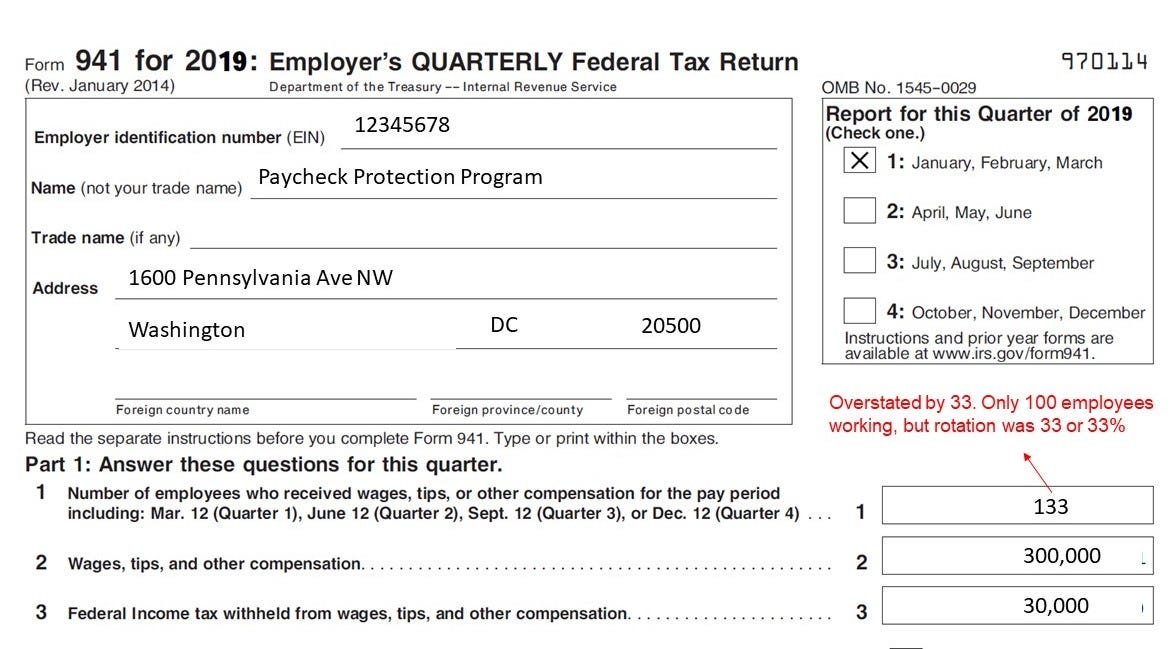

Step By Step How To Guide To Filing Your 941 X Ertc Baron Payroll

Following the first disbursement of the PPP loan Answer.

. Correction to the Instructions for Form 941 Rev. In the Calculate Based on Quantity window select Neither and then select Next. The following methodology should be used to calculate the maximum amount that can be borrowed for partnerships partners self.

Calculate average monthly payroll costs divide the amount from Step 2 by 12. For PPP 2 you can choose up to a maximum of 24 weeks. You simply calculate all monthly wages and contribution for employees divide by.

If you received a Paycheck Protection Program Loan you might be wondering how much of that loan may be forgiven. It is for information. Multiply the average monthly payroll costs from Step 3 by 25.

Last updated February 22 2021. June 2021 -- 19-OCT-2021. 1040 Schedule C Used to Calculate 2019 or 2020 IRS FORM 941 and State Quarterly Wage Unemployment Insurance or equivalent payroll processor records Payroll Statement or.

If you got the PPP or missed it the CARES Act has been amended to make ERC available. Interest for PPP loans is calculated at 1 from the date of loan disbursement. Ad Reminder for business owners with W2 employees who havent claimed their ERC refund.

On the Default rate and limit window make sure the rate. On the Taxes window select Next. Enter the number of weeks you are electing as your covered period.

Calculating payroll costs for the PPP is a lot easier than it sounds at the outset. Enter the ERTC credit you are eligible for in 2021. The PPP Forgiveness Estimator is based on the information you provide.

Calculate the average monthly net profit amount divide amount in step a by 12 Multiply the average monthly net profit amount X 25. The PPP loan is issued to cover 10 weeks of monthly payroll expenses hence the multiplier of 25x.

Snip 201801051025010 Windows Phone Windows 10 Mobile Get Started

1

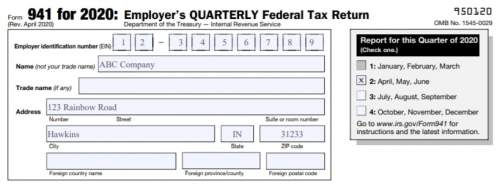

Updated Form 941 Irs The Latest Changes For Q2 Q4 2020

Irs Releases New Draft Of Form 941 For 2020 Laporte

How To Fill Out The New Form 941 When You Have Ppp Or Eidl Youtube

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

2

1

3

Us Updates To Form 941 Help Center

Us Updates To Form 941 Help Center

How To File Form 941 For The 1st Quarter 2021 Taxbandits Youtube

Sample

How To Calculate The Number Of Full Time Equivalent Employees Ftees By George Benaroya Medium

2

Form 941 Frequently Asked Questions

Us Updates To Form 941 Help Center